After weeks of debate in the press and the U.S. Congress, few concrete recommendations about how to insure the future of the big three U.S. auto makers have surfaced. Lost in the noise is the following insight about the General Motors Corporation (GM: NYSE) in a Bloomberg News interview of Jerry York:

As I look at the GM numbers, they’ve actually done 22.3% of the U.S. market year to date. But when you look at their level of fleet sales and the very heavy level of incentive spending to move product, their natural share level is down in the 15 to 17 % range.

One way to define a company’s “natural share level” is the point at which the last dollar earned just equals its cost. Based on this definition, Mr. York’s estimate is a bit on the high side. GM’s natural share level was 12.7% of the $160.3 billion combined worldwide revenues of GM, Ford Motor Co. (F: NYSE), Nissan Motor Co. Ltd. (NSANY: NASDAQ) and Toyota Motor Co. (TM: NYSE) at the close of the 2nd quarter 2008. There is another famous company -- whose name happens to rhyme with GM -- which was forced to lose market share in order to remain afloat.

IBM’s NATURAL SHARE LEVEL

You may remember Jerry York from his days as CFO of International Business Machines (IBM: NYSE) in 1993. He’s the guy who figured out that IBM had a $7 billion dollar problem. Fixing that problem required massive downsizing. For a brief account of these events see my March 13, 2007 post Make an Elephant Dance.

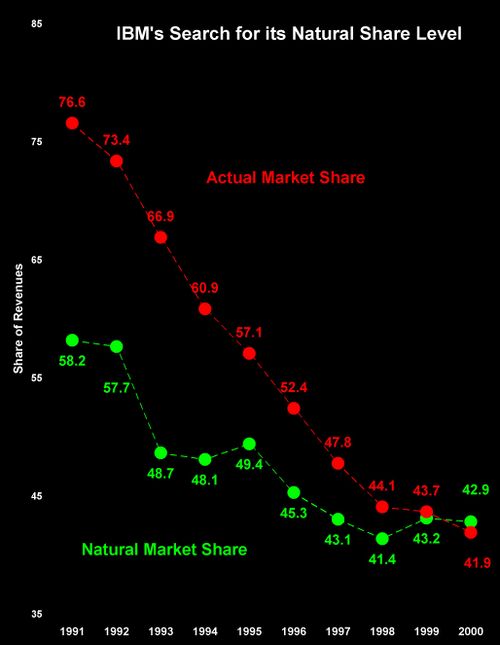

Over the years from 1993 through 2000 Lou Gerstner took IBM from the brink of failure to what I define as its natural share level. I trace the history of this extraordinary journey in my 14 minute audio slide show The Battle for Your Desktop. This chart tells the story.

The red schedule in this chart is IBM’s actual market share in a group with Compaq Computer Corporation, Dell Inc. (DELL: NASDQ) and Hewlett-Packard Company (HPQ: NYSE) from 1991 through 2000. The green schedule is IBM’s natural market share over the same period. In 1991 IBM’s actual share was 76.6% of $84.6 billion in group revenues. In that year the company’s natural share level was 58.2%. An over reach of 17.4 share points.

IBM’s actual sales revenues in 1991 were $64.8 billion. Its natural sales revenues were $49.2 billion. In other words, fifteen months before Gerstner and York took over, IBM had $15.6 billion in unprofitable revenues. IBM had billions in unprofitable revenues as a result overspending on everything required to sustain that 76.6% market share. John Akers, the previous CEO, planned to break the company into eight parts. Gerstner reversed that decision in favor of searching for IBM’s natural share level … and found it.

By the close of business in 1999, Gerstner and York had led IBM to the point where actual and natural market share were nearly equal: 43.7% vs. 43.2%. At that point the company’s actual and natural sales revenues were $87.5 vs. $86.5 billion respectively. In that year IBM’s actual and natural EBITDA were virtually the same -- $16.234 vs. $16.238 billion. The results were much the same in 2000.

What did investors think of this dramatic drop in market share? IBM’s market cap was $28.7 billion when Gerstner took control. By the end of 2000 its market cap was $148.1 billion. Here’s the punch line: when a company’s actual and natural market share are equal, investors’ reward management by bidding up the share price.

GM’s NATURAL SHARE LEVEL

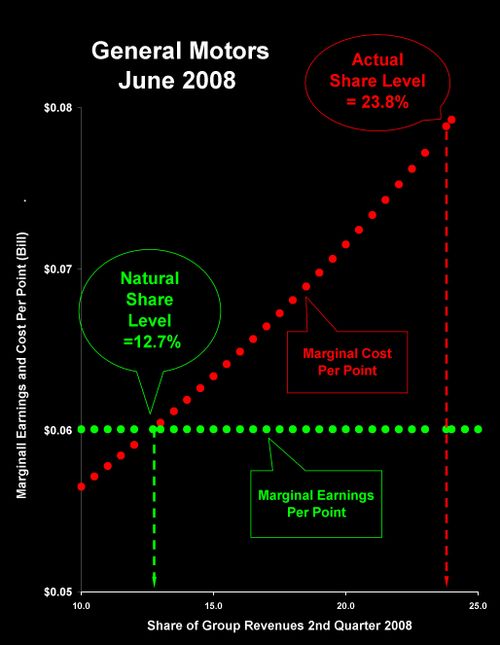

In his Bloomberg interview, Jerry York gave an intuitive name to a metric in Competing for Customers and Capital: maximum earnings market share. That’s the unknown share of revenues at which earnings from the next share point equal the cost of acquiring it. The concept is simple, but the name “maximum earnings market share” was descriptive only in the arcane language of microeconomics. This chart shows the natural share level for GM in June 2008: the share of revenues where marginal earnings equal marginal costs per share point.

The green horizontal line in this chart is GM’s marginal earnings per share point. The marginal earnings schedule is constant, because this static analysis assumes there is no change in the company’s underlying capital structure or cost of goods sold. The red line in this chart is GM’s marginal cost per share point. This schedule rises sharply in recognition of the fact that the marginal cost of a share point increases. It costs more at the margin to gain the 23rd share point than the one before it – even accounting for scale and scope efficiencies.

With the phrase “natural share level” Mr. York (unknowingly) gave intuitive meaning to the point where marginal earnings equal marginal cost per share point. Turns out that GM’s natural share is almost half its actual share of revenues.

GM’s income statement clearly documents the problem. The company’s cost of goods sold in June was $36.7 billion. Its sales revenues were $38.2 billion. So, on average it cost GM nearly $0.94 to produce $1.00 in sales. This is the legacy of those fleet sales and incentive spending that Jerry York mentioned in his Bloomberg interview. Discounted fleet sales and heavy incentives largely were responsible for driving down the average revenue per vehicle almost to its manufacturing cost. In addition, GM’s spending on advertising, selling and administrative staff added a layer of enterprise marketing costs that were a little over $2 billion more than required at their natural share level of 12.7%.

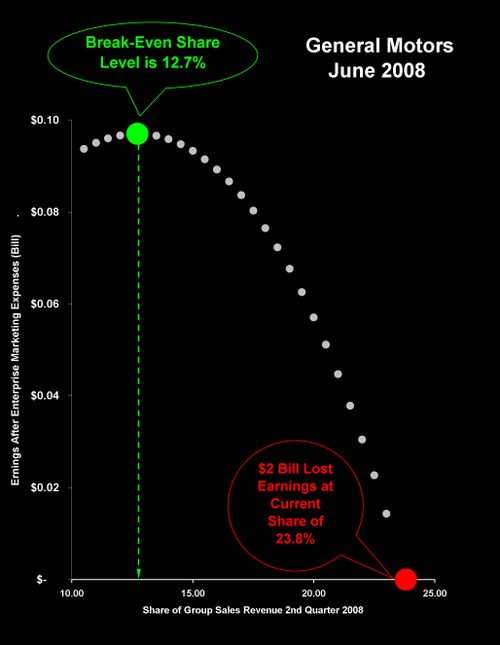

GM’S BREAKEVEN SHARE LEVEL

At this period in the company’s history its natural share level and breakeven share are equivalent. This is due to its inflated capital structure and bloated cost of goods sold. This chart documents the effect of reducing administrative costs to their breakeven level.

If management were to cut its selling, general and administrative expenses by $2 billion per quarter it would breakeven at 12.7% of group revenues. This would save enough cash to stay afloat. As Mr. York said in his Bloomberg interview “You just quit spending every possible way that you can. You comb through every account.”

This is just the first step. In order to achieve a sustainable long run position GM’s capital structure and manufacturing operations must be transformed. A discussion of such restructuring and transformation is beyond the natural scope of market share analysis.

CAN GM BE LIKE IBM?

Like IBM in 1991, GM in 2008 finds itself unable to sustain its market position. The question is: Who is willing to search for GM’s natural share level and take the actions necessary to achieve it?

Thanks for visiting. As always, your comments are welcome.

~V

Thank you for the helpful information. I bookmarked your site, and I hope you keep up the good work on making your blog a success!

Posted by: Rachael S. | February 06, 2009 at 09:24 AM

Jonathan, thank you for your thoughtful comments. You ask a fundamental question -- for which there is no clear cut answer. Elimination of redundant manufacturing assets may (or may not) increase GM’s natural market share. On the one hand, the cash from sale of these assets would enter the company’s balance sheet and likely have no direct affect on cost of goods sold in the remaining plants. Therefore, gross margins would remain the same. On the other hand, removing the vehicles produced by the redundant factories likely would reduce the downward pressure on prices due to fleet sales and consumer incentives. This would increase the average revenue per vehicle and thus increase gross margins, boosting GM’s natural share level a bit. In either case, long-term success of the company probably depends on even more radical actions than massive changes in the scale and scope of its operations. Following the lead of IBM’s turnaround, what GM may need is an entirely new business model.

~V

Posted by: Doc | January 07, 2009 at 10:21 AM

Another fascinating post, Victor. The contrast between the 24% actual market share and the 13% natural market share is even more stunning than for IBM. I wonder, however, if the natural market share for GM might be somewhat higher once you eliminate the massive manufacturing redundancies that exist in maintaining 8 brands (IBM had unprofitable divisions but did not suffer from the same level of redundancy?). But, in any event, the scale of the required change is massive.

Posted by: Jonathan Knowles | January 06, 2009 at 10:41 PM

Very interesting Victor! I am amazed of how into the topic you are!

Posted by: Marcos Escobar | December 24, 2008 at 01:59 PM