DUKING IT OUT

On June 14, 2007 the New York Times DealBook reported the latest development in the Exchange War between the "ICE" and the "CME" over a property they both want:

As two of the Chicago Board of Trade’s rivals continue duking it out over the exchange, its board of directors spoke up on Thursday: it favors the Chicago Mercantile Exchange.

But the IntercontinentalExchange Inc. (ICE) seems to want the Chicago Board of Trade (BOT) badly. Dow Jones MarketWatch reported late Tuesday June 12 that the company had enhanced its offer. It now represents a 10.2% premium over Chicago Mercantile Exchange (CME) bid. And

ICE also said it plans to file a preliminary proxy statement to oppose the proposed acquisition of CBOT Holdings by the Chicago Mercantile Exchange (CME) and solicit votes against the proposed CBOT/CME merger at the CBOT shareholders meeting scheduled for July 9.

Given the reported challenges faced by ICE in shifting CBOT's action to its New York Board of Trade platform, as well as the premium it has already offered to pay for the property, one wonders what's behind this ambitious strategy. CEO Jeffrey Sprecher says "It's a growth play." Is he right?

THE THREE PARTS OF A DOLLAR

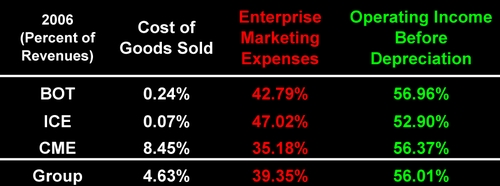

To understand the motives behind an audacious strategic move like Mr. Sprecher's, it's useful to start with the enterprise marketing concept of "the three parts of a dollar." Why? Because it divides the sales dollar up into three mutually exclusive and exhaustive parts that define, with the use of financial accounting data, the company's underlying business model.

COST OF GOODS SOLD

The "cost of goods sold" at the Chicago Board of Trade in 2006 was 0.24%. Does this mean the company's gross margin is over 99%? Yes. Think of these three companies as retailers of risky financial products to highly select clients. Here's how the CBOT defined its business in its 2006 annual report:

CBOT Holdings was formed in April 2005 as a Delaware corporation for the purpose of becoming the holding company of the CBOT which was founded in 1848. Today, the CBOT is the world’s leading marketplace for trading agriculture, grains and U.S. Treasury futures as well as options on futures. In 2006, 13% of the global listed futures and options on futures contracts traded at the CBOT.

It's clear the company does not have a "cost of goods sold" like a product manufacturer or retailer. So what is cost of goods sold at such companies? Simple. The interest paid on borrowed money. The CME was the least efficient with an interest cost of goods sold equal to 8.45%. ICE was the most efficient with a cost of just 0.07%.

ENTERPRISE MARKETING EXPENSES

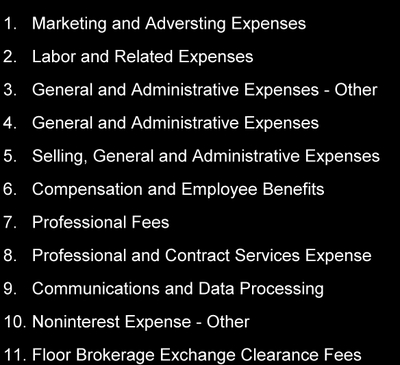

Calculating the enterprise marketing expenses of these three companies is a little more complicated. And you can't take the SG&A expenses reported in online services. Often the result make no sense. For example, Yahoo! Finance reported that the Chicago Mercantile Exchange had SG&A expenses of +$24.615 million in the 2nd quarter of 2006!

You have several options in assembling enterprise marketing expenses from the income statements of these exchange services. The least attractive option is to comb through each company's annual report and pick out all the line items that fit this definition:

Enterprise marketing expenses are the costs of everyone (and everything) that affects a company's performance in its competition for customers and capital.

If you're interested in the details of which expenses fit this definition see my audio slide show on "Enterprise Marketing Expenses." It runs about 12 minutes.

The most attractive option in my experience is to subscribe to EDGAR Online I*Metrix services:

I-Metrix is a suite of interactive data and analytical tools from EDGAR Online that provides quick and accurate, XBRL-tagged financial statement data via Microsoft Excel and an easy to use web interface or via a direct data feed.

Here's a list of all the line items in the income statements reported by I*Metrix that include at least a single entry for one (or more) of these three companies in their 2006 income statements:

Each of these enterprise marketing expenses influence the company's performance in competing for customers and capital. Here are the enterprise marketing expenses of each company.

There are two big advantages in using I*Metrix to assemble enterprise marketing expenses. First, the line items are standardized across all companies (whether or not they report the expense separately). Second, with a single mouse click you can drill down into the original SEC document to discover which items, if any, were combined.

COULD IT BE MARKET SHARE?

Revenues for the group of three firms totaled just over $2 billion at the end of 2006. The CBOT captured 30.7%, ICE got 15.5%, and CME led the group with 53.8%.

Could it be that ICE covets BOT because the combined firms would achieve maximum earnings market share and leapfrog the Merc?

I applied The Rule of Maximum Earnings (this audio slide show runs 12 minutes) to the data for the CBOT.

CBOT's actual operating income was $354 million on a market share of 30.7%. Maximum OIBD of $418 billion occurs at 45.5%. How could the Chichao Board of Trade grow that much additional share? If BOT were acquired by ICE their combined market share would be 46.2%! That's only 52 basis points from BOT's maximum earnings share.

WHY LEAVE $100 MILLION ON THE TABLE?

Okay, but what about the alternative? The Merc already owns 53.8% of this market. If it wins the exchange war, the company will own 84.5% of the market. This will maximize its earnings, right? Wrong. This chart shows what happens to market share and earnings if CME wins the bet for the CBOT.

If the Merc wins the bidding, combined earnings of the merged companies would be $968 million at a market share of 84.5% on sales revenues of $1,711 million (in red). While maximum earnings of the combined firms are $1,078 million at a 75% market share on revenues of $1,520 million (in green).

Even if the Merc bid doesn't run into anti-trust issues, the market eventually will drive it to downsize to a point closer to its maximum earnings market share. Why? Because the merged companies will leave over $100 million in earnings on the table.

A BIG ROLE FOR ENTERPRISE MARKETING

Where does traditional marketing fit in this seemingly complicated story? Look back at the list of line items from the income statements that contribute to enterprise marketing efforts. The first one is Marketing and Advertising expenses. Only the Chicago Mercantile Exchange reported any of these traditional expenses. And the total was just $16.74 million in 2006. In a strategic group with revenues of $2.0 billion. Traditional marketing's slice of this pie isn't even rounding error.

Does this mean traditional marketing has only a small role to play in financial institutions that serve a relatively small set of highly select customers? Yes, but enterprise marketing can step in and offer CEOs and CFO's unexpected insights into the challenges they face in the competition for customers and capital --- even in esoteric markets. In this case, it appears that the CBOT should think about switching its bet to the ICE before the window closes on July 9, 2007. What do you think?

~V

Professor,

The economic numbers I am talking about are the cash flows presented in the merger documents. I have a copy of them, but have no way of transposing them here. They do not show numbers for ICE, but almost certainly, ICE cannot begin to recoup the kind of cost efficiencies in a merger that CME can capture purely because of the floor, and the economy of scale and scope that it would bring to CBOT versus ICE. ICE has no economies of scale, or scope.

Only shareholders of record were mailed the merger documents. Maybe an analyst has them. They calculated ten years of cash flows and discounted them, including a terminal value. Like all good investment bankers, they were sketchy about the discount rate, the terminal value of the CBOT, and the WACC. They gave a range of values for growth and how they discounted, along with the type of multiple they used.

The exchange business is a fixed cost business. There is little variability to their costs. Even if no one makes a trade that day, they incur the same costs as if ten million trades were executed.

The fixed costs are the labor to run the computer system, and trading floor. It used to take around 30 million a year to operate a trading floor.

CME carries zero debt. All of their growth has been paid for with cash. The interest that you see is from the operation of the clearing house. They also receive interest from margin deposits. Last year, I think they made around 2 million off this activity.

Pre merger, there is virtually no LTD or STD on the balance sheet. If you look at the notes to the financial statements, there is a schedule illustrating the pays and collects of the interest.

There is approved preferred stock, but none has been issued. 100 million shares of stock are approved, and around 36 million are issued.

The CBOT does carry debt, and it is due to the building that they own. It is their most valuable LT asset.

All exchanges have fee schedules on their websites. You might have to dig a bit for them. At the CME, different contracts have different costs, so it is very hard to know what their actual revenue per contract and cost per contract is. If you take the actual RPC number published by the exchange as gospel, it's about .60. I think that they can clear for far lower than that, probably in the range of .01-.03.

The eurodollar is the CME's busiest. If you are an equity member, in this case a B-2, and trade low volume, it costs you .16 a side on GLOBEX, and .08 a side in the pit. If you trade higher volumes, you get a discount. At the highest volume of trade (I think it's more than 30000 round turns a day, you pay .02 a side in the pit)

The CBOT never has a line item for clearing revenue until they jointly started clearing the CME. That revenue stream goes away with any deal with ICE, and gets melded into CME with a merger.

I hope this helps clarify the issues. No question if you want out of your stock on the day of the merger, vote ICE. You get more money per share. If you are interested in building a business, or if you have to hold stock because you are a clearing firm or ERP holder, you should vote for CME because it is the better long term play. My intuition tells me that most of the CBOT shareholders are long term players. ERP holders have at least 27% of the stock.

Posted by: jeff | June 21, 2007 at 03:53 PM

Dear Jeff,

Thank you for your thoughtful reply. It gives me a much better understanding of your major concerns with my analysis. To get a bit closer to the bottom line on these issues, I've plugged quotes from your reply (IN CAPS) into your areas of concern so we both can see what differences remain.

YOU NEED TO LOOK AT ECONOMIC NUMBERS

Please tell me what economic numbers I should use in place of financial accounting data.

"IT IS BEST TO AT LEAST LOOK AT THE PROXY DOCUMENTS PUT FORWARD BY THE M+A GUYS TO LOOK AT THEIR NUMBERS TO TRY AND GET A HANDLE ON THE REAL NUMBERS."

We're getting closer. But I need to know more. Please share with me the answer to these two further questions:

1. What exactly do "their numbers" measure?

2. How can an individual investor can get access these numbers?

YOUR COGS IS VERY FLAWED

Aren't most all of the "internal costs that it takes to trade a contract" are incurred whether or not a give trade is made?

You clarify your concern by saying "... NO ONE RATIONAL WOULD USE INTEREST RATE CHARGES TO IMPUTE COGS UNLESS THERE WAS AN ECONOMIC REASON TO LINK INTEREST TO COGS."

I wouldn't use interest rate charges to impute GOGS unless I though there were an economic reason to do so.

But, you didn't answer my question. Can I assume it's correct to say that most all internal costs that it takes to trade a contract (e.g. people, occupancy) are incurred whether or not a given trade is made? To be clear, are the strictly variable costs of all trades made in a fiscal year far less than the fixed costs of the trading operation? By variable costs, I mean those that would NOT be incurred if a trade were not made.

CME CARRIES NO DEBT

Then how did CME incur $92 million in interest expenses in 2006?

I understand that "PAYS AND COLLECTS EQUAL ZERO EVERY DAY." But I still don't understand how CME incurred that $92 million in interest expenses. Do you know?

YOUR ANALYSIS OF MARKET SHARE IS INVALID

I agree that "The exchanges don't compete on any products head to head." But they do share customers. And so they compete for capital head to head do they not?

"OF COURSE EXCHANGES SHARE CUSTOMERS. BUT IF YOU DID A PIE CHART OF THE CUSTOMER UNIVERSE, EVERY CUSTOMER OF THE ICE IS A CUSTOMER OF CME, BUT NOT VICE VERSA. ICE IS A MINISCULE PART OF THE BUSINESS."

Okay, but this would change dramatically if ICE won its quest for BOT. Right?

YOUR ANALYSIS ASSUMES MARKET IS A FIXED PIE

You're right; my analysis looks only at a single year. But that doesn't mean I believe the market for futures is a fixed pie. Would you like to see a multi-period analysis?

"I THINK THAT TO ASSUME ONE YEAR IN A CONTINUOUS GAME IS INCORRECT."

I stand corrected on this count. And I agree with you. When we come to terms on the other issues I'll do a multi-period analysis. But it will not be a single firm discounted cash flow analysis. I believe a multi-period, multi-firm competitive stock valuation provides a more complete picture of future outcomes in an M&A analysis.

YOUR ANALYSIS DOESN'T INCLUDE STRATEGIC REASONS

Do you not agree that maximizing shareholder returns is a strategic reason?

"SHAREHOLDER VALUE IS ONLY ONE STRTEGIC CONSIDERATION ... LOOKING EXCLUSIVELY AT SHAREHOLDER RETURNS WILL SOMETIMES GET YOU INTO TROUBLE. YOU WILL MICROMANAGE THE BUSINESS FOR THE SHORT RUN, AND LOSE BIG TIME IN THE LONG RUN. "

I'm please to find we agree at least on the importance of shareholder returns and the need for a long term analysis.

YOUR ANALYSIS DOES NOT INCLUDE COST SAVINGS

Your right, it does not include cost savings. Please tell me a bit more about why "no other exchange can gain the same amount of synergies?"

"... TO IGNORE THE AMOUNT OF CAPITAL AND INTEGRATION COSTS ICE WOULD HAVE IF THEY TRIED TO SWALLOW THE CBOT IS DISINGENUOUS."

Jeff, I must tell you that "disingenuous" is a bit strong. I may be uniformed on the capital and integration costs, but I'm not lacking in frankness, candor, or sincerity.

At this point I would like to know if others share your view that ICE:

"... WOULD HAVE TO SPEND A MINIMUM OF 300-350 MILLION TO UPGRADE THEIR CLEARING HOUSE AND GET A FIRST CLASS TRADING ENGINE. ICE HAS A SECOND RATE ENGINE NOW THAT FREEZES WHEN IT GETS BUSY."

And now we come to the heart of the COGS problem.

JUST TO LET YOU KNOW HOW LOW CME GOGS IS, A FULL MEMBER CAN TRADE ONE ROUND TURN FOR AS LOW AS .16. AND THE CME MAKES MONEY. ICE CHARGES AROUND .82 FOR THE SAME SERVICE. SO WE KNOW THAT COGS IS LOWER THAN .16 PER CONTRACT. IF WE ASSUME A 57% PROFIT MARGIN, THEN .09 IS THE COGS. THEY DID 1.3 BILLION LAST YEAR, AND NOT ALL THE VOLUME WAS TRADED AT MEMBER RATES.

Just one final question: is that $0.09 per trade? If so this means (unadjusted for non-member rates) the GOGS for the CME last year was about $117 million.

~V

Posted by: Victor Cook, Jr., New Orleans, Louisiana | June 19, 2007 at 05:47 PM

First off, the numbers that are used in annual reports are accounting numbers. It is best to at least look at the proxy documents put forward by the M+A guys to look at their numbers to try and get a handle on the real numbers. The numbers you used are simple financial accounting numbers, and not ones that you should use to guide your decision making.

If you use them in the real world, you are almost doomed to failure, or really lucky.

For example, no one rational would use interest rate charges to impute COGS unless there was an economic reason to link interest to COGS. In this case COGS is the cost to trade a contract.

If you looked at the CME financial statements, you would see a corresponding debit and credit for interest income. This is purely the income paid, and the income received from the operation of the Clearing House. It makes virtually no money on time deposits that are kept in it, because futures is a zero sum game. Pays and collects equal zero every day.

Of course exchanges share customers. But if you did a pie chart of the customer universe, every customer of the ICE is a customer of CME, but not vice versa. ICE is a miniscule part of the business, trading 400K a day. CME eurodollars trade 400K before the equities open each day. If you compare capital flows, it is no contest. ICE has one hot product, Brent crude that it trades. In every spot where it competes head to head with NYMEX it is losing market share. WTI and Dubai. ICE does hold a significant market share in OTC energy derivatives, that it inherited when Enron fell apart.

I think that to assume one year in a continuous game is incorrect. Most M+A that I have seen take discounted cash flows and terminal values out 10 years. To look at one year is incorrect and arbitrary. It is not statistically relavant. It makes for bad analysis.

ICE was initially able to gain market share purely because they were the only electronic energy game in town. Once NYMEX partnered with CME, ICE began to lose market share. The futures businss itself has grown exponentially over the past three to four years. Every exchange has benefitted from it. Some more than others.

Shareholder value is only one strtegic consideration, and it depends on how you frame it. Long term or short term. If you are a scalper, you look at the very short term, minute to minute or even day to day. In that case, you can momentum trade the ICE versus CBOT/CME arb and make money. But to ignore the amount of capital and integration costs ICE would have if they tried to swallow the CBOT is disingenuous. They would have to spend a minimum of 300-350 million to upgrade their clearing house and get a first class trading engine. ICE has a second rate engine now that freezes when it gets busy.

It cannot possibly handle the volume of the CBOT. It doesn't have the cash flow to finance an expansion like that, and would have to go to the junk bond market to get it.

Looking exclusively at shareholder returns will sometimes get you into trouble. You will micromanage the business for the short run, and lose big time in the long run. One of the fundemental complaints about American business is that it focuses too much on tomorrow, and forgets about next year.

To ignore cost savings as a result of a merger is to ignore one of the basic reasons for the merger. How is ICE going to save money by consolidating trading floors? It can't. Can it save money in its clearing? it can't, because it needs to build more scale to handle the CBOT. Can ICE save money on it's front end? Again it can't because the front end it has cannot handle the business.

CME can save money on all three of these things. It can charge CHEAPER rates for CBOT clearing because it will be eliminated from CBOT as a profit center. GLOBEX can already handle CBOT, it handles NYMEX growing busines easily with no slowdown. Both trading floors can be consolidated saving on staff and floor costs. Fixed and variable costs of the exchanges will be reduced.

Excluding the financial analysis, the CBOT has lost a ton of staff. They have no front end, and no back end which opens them up to head to head competition in the long run. Customers have saved 3 billion dollars in capital costs through common clearing and that goes away with a merger with ICE.

CBOT has been managed the last several years as a buy out target. They have cut expenses, and tried to retire debt. They are not a business that has been managed like they are in the game for the long haul.

Just to let you know how low CME GOGS is, a full member can trade one round turn for as low as .16. And the CME makes money. ICE charges around .82 for the same service. So we know that COGS is lower than .16 per contract. If we assume a 57% profit margin, then .09 is the COGS. They did 1.3 billion last year, and not all the volume was traded at member rates.

Posted by: jeff | June 19, 2007 at 03:39 PM

Dear Jeff,

Thank you for your comments. I need a better understanding of them before I can respond thoughtfully. Let's take what I see as your major concerns one step at a time.

YOU NEED TO LOOK AT ECONOMIC NUMBERS

Please tell me what economic numbers I should use in place of financial accounting data.

YOUR COGS IS VERY FLAWED

Aren't most all of the "internal costs that it takes to trade a contract" incurred whether or not a given trade is made?

CME CARRIES NO DEBT

I guess I don't understand this statement since CME reported $92 million interest expenses in 2006. How did they incur this expense?

YOUR ANALYSIS OF MARKET SHARE IS INVALID

I agree that "The exchanges don't compete on any products head to head." But they do share customers. And so they compete for capital head to head do they not?

YOUR ANALYSIS ASSUMES MARKET IS A FIXED PIE

You're right, my analysis looks only at a single year. But that doesn't mean I believe the market for futures is a fixed pie. Do you believe a single period analysis necessarily is wrong?

YOUR ANALYSIS DOESN'T INCLUDE STRATEGIC REASONS

Do you not agree that maximizing shareholder returns is a strategic reason?

YOUR ANALYSIS DOES NOT INCLUDE COST SAVINGS

Your right, it does not include cost savings. Please tell me a bit more about why "no other exchange can gain the same amount of synergies?"

~V

Posted by: Victor Cook, Jr., New Orleans, Louisiana | June 18, 2007 at 05:19 PM

Dear Professor,

I respectfully disagree with your analysis. First, you are using accounting numbers to guide your decision. Financial reporting numbers are not good numbers to use when you analyze a business.

You need to look at economic numbers.

Your analysis of COGS is very flawed, and it is deceitful to use the numbers you are using. COGS in the exchange business is not the interest that an exchange pays. There is COGS, and it is made up of the internal cost that it takes to trade a contract. If you were consistent in using interest paid as COGS, then the CME's would be zero since it carries no debt. It has used cash to fund growth.

Your analysis of market share is similarly invalid. The exchanges don't compete on any products head to head. You analysis assumes that they do, and also assumes that the market for futures is a fixed pie. In the only market where there is head to head competition, NYMEX vs ICE in WTI futures, the NYMEX is consistently winning. It is taking market share from the ICE.

Your analysis also doesn't include the strategic reasons and cost savings that the CME and CBOT would gain from a merger. No other exchange can gain the same amount of synergies. It is similar to the situation now in New York; only the NYSE can gain from a merger with the NYMEX as far a synergistic cost savings from combination of trading floors.

Posted by: Jeff Carter | June 18, 2007 at 03:37 PM