DUKING IT OUT

On June 14, 2007 the New York Times DealBook reported the latest development in the Exchange War between the "ICE" and the "CME" over a property they both want:

As two of the Chicago Board of Trade’s rivals continue duking it out over the exchange, its board of directors spoke up on Thursday: it favors the Chicago Mercantile Exchange.

But the IntercontinentalExchange Inc. (ICE) seems to want the Chicago Board of Trade (BOT) badly. Dow Jones MarketWatch reported late Tuesday June 12 that the company had enhanced its offer. It now represents a 10.2% premium over Chicago Mercantile Exchange (CME) bid. And

ICE also said it plans to file a preliminary proxy statement to oppose the proposed acquisition of CBOT Holdings by the Chicago Mercantile Exchange (CME) and solicit votes against the proposed CBOT/CME merger at the CBOT shareholders meeting scheduled for July 9.

Given the reported challenges faced by ICE in shifting CBOT's action to its New York Board of Trade platform, as well as the premium it has already offered to pay for the property, one wonders what's behind this ambitious strategy. CEO Jeffrey Sprecher says "It's a growth play." Is he right?

THE THREE PARTS OF A DOLLAR

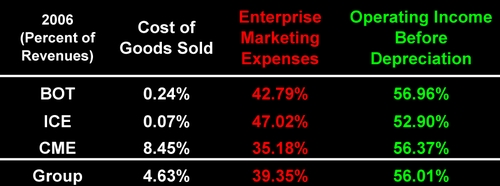

To understand the motives behind an audacious strategic move like Mr. Sprecher's, it's useful to start with the enterprise marketing concept of "the three parts of a dollar." Why? Because it divides the sales dollar up into three mutually exclusive and exhaustive parts that define, with the use of financial accounting data, the company's underlying business model.

COST OF GOODS SOLD

The "cost of goods sold" at the Chicago Board of Trade in 2006 was 0.24%. Does this mean the company's gross margin is over 99%? Yes. Think of these three companies as retailers of risky financial products to highly select clients. Here's how the CBOT defined its business in its 2006 annual report:

CBOT Holdings was formed in April 2005 as a Delaware corporation for the purpose of becoming the holding company of the CBOT which was founded in 1848. Today, the CBOT is the world’s leading marketplace for trading agriculture, grains and U.S. Treasury futures as well as options on futures. In 2006, 13% of the global listed futures and options on futures contracts traded at the CBOT.

It's clear the company does not have a "cost of goods sold" like a product manufacturer or retailer. So what is cost of goods sold at such companies? Simple. The interest paid on borrowed money. The CME was the least efficient with an interest cost of goods sold equal to 8.45%. ICE was the most efficient with a cost of just 0.07%.

ENTERPRISE MARKETING EXPENSES

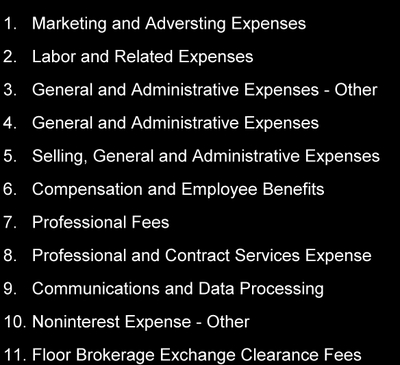

Calculating the enterprise marketing expenses of these three companies is a little more complicated. And you can't take the SG&A expenses reported in online services. Often the result make no sense. For example, Yahoo! Finance reported that the Chicago Mercantile Exchange had SG&A expenses of +$24.615 million in the 2nd quarter of 2006!

You have several options in assembling enterprise marketing expenses from the income statements of these exchange services. The least attractive option is to comb through each company's annual report and pick out all the line items that fit this definition:

Enterprise marketing expenses are the costs of everyone (and everything) that affects a company's performance in its competition for customers and capital.

If you're interested in the details of which expenses fit this definition see my audio slide show on "Enterprise Marketing Expenses." It runs about 12 minutes.

The most attractive option in my experience is to subscribe to EDGAR Online I*Metrix services:

I-Metrix is a suite of interactive data and analytical tools from EDGAR Online that provides quick and accurate, XBRL-tagged financial statement data via Microsoft Excel and an easy to use web interface or via a direct data feed.

Here's a list of all the line items in the income statements reported by I*Metrix that include at least a single entry for one (or more) of these three companies in their 2006 income statements:

Each of these enterprise marketing expenses influence the company's performance in competing for customers and capital. Here are the enterprise marketing expenses of each company.

There are two big advantages in using I*Metrix to assemble enterprise marketing expenses. First, the line items are standardized across all companies (whether or not they report the expense separately). Second, with a single mouse click you can drill down into the original SEC document to discover which items, if any, were combined.

COULD IT BE MARKET SHARE?

Revenues for the group of three firms totaled just over $2 billion at the end of 2006. The CBOT captured 30.7%, ICE got 15.5%, and CME led the group with 53.8%.

Could it be that ICE covets BOT because the combined firms would achieve maximum earnings market share and leapfrog the Merc?

I applied The Rule of Maximum Earnings (this audio slide show runs 12 minutes) to the data for the CBOT.

CBOT's actual operating income was $354 million on a market share of 30.7%. Maximum OIBD of $418 billion occurs at 45.5%. How could the Chichao Board of Trade grow that much additional share? If BOT were acquired by ICE their combined market share would be 46.2%! That's only 52 basis points from BOT's maximum earnings share.

WHY LEAVE $100 MILLION ON THE TABLE?

Okay, but what about the alternative? The Merc already owns 53.8% of this market. If it wins the exchange war, the company will own 84.5% of the market. This will maximize its earnings, right? Wrong. This chart shows what happens to market share and earnings if CME wins the bet for the CBOT.

If the Merc wins the bidding, combined earnings of the merged companies would be $968 million at a market share of 84.5% on sales revenues of $1,711 million (in red). While maximum earnings of the combined firms are $1,078 million at a 75% market share on revenues of $1,520 million (in green).

Even if the Merc bid doesn't run into anti-trust issues, the market eventually will drive it to downsize to a point closer to its maximum earnings market share. Why? Because the merged companies will leave over $100 million in earnings on the table.

A BIG ROLE FOR ENTERPRISE MARKETING

Where does traditional marketing fit in this seemingly complicated story? Look back at the list of line items from the income statements that contribute to enterprise marketing efforts. The first one is Marketing and Advertising expenses. Only the Chicago Mercantile Exchange reported any of these traditional expenses. And the total was just $16.74 million in 2006. In a strategic group with revenues of $2.0 billion. Traditional marketing's slice of this pie isn't even rounding error.

Does this mean traditional marketing has only a small role to play in financial institutions that serve a relatively small set of highly select customers? Yes, but enterprise marketing can step in and offer CEOs and CFO's unexpected insights into the challenges they face in the competition for customers and capital --- even in esoteric markets. In this case, it appears that the CBOT should think about switching its bet to the ICE before the window closes on July 9, 2007. What do you think?

~V

Jeff,

Your comments on scalability and the history of electronic trading at the CME are informative and relevant. The comparisons you and others associated with the CME have made involve its size and scalability relative to ICE, rather than BOT's size and the scalability of the ICE engines. Of course, this is because you believe "The two exchanges together can make a great economic powerhouse." I have no doubt this is true. Combined a CME/BOT would begin life with 84.5% of the revenues in a market growing at a same-quarter average annual rate of 38%.

The overarching question in my way of thinking remains: Will this great economic powerhouse necessarily lead to a more profitable, more highly valued enterprise? Compared with the lean, mean, maximum earnings trading machine the CME already is as a stand alone enterprise? I know this is an "academic" question, but I think that makes it no less important to the company.

Your closing comment on price discovery is very interesting: it's "... taking place away from NYC, and on futures and options screens." I wasn't fully aware of the impact electronic trading was having on futures markets. Your comment so peaked my curiosity as to send me searching the net for references. One that popped up was your March 22, 2000 review of Patrick Young's book on "Capital Market Revolution: The Future of Markets in an Online World." You conclude with this statement:

"I am on the Board of Directors at the Chicago Mercantile Exchange, so I speak from experience. The revolution has begun and we are trying to embrace it."

This led me to search for your name on Google: I discovered you're co-founder of the Hyde Park Angels, an MBA from the University of Chicago, a senior trader at the CME and contributor to CNBC Squawk Box, CNBC Power Lunch, CNBC Power Lunch Europe, CNBC Squawk Box Asia, Bloomberg on the Markets, CBS News, and CNN.

Imagine my surprise to discover these facts. From your comments on this post I suspected you were probably a full member on the CME. Either that or an experienced CME trader who had recently gone back to get an EMBA from the GSB! Thanks for making this thread more interesting and substantive.

I look forward to your comments on my next entry in this series. The working title: "Exchange Wars: Post-Merger Market Values?" In this article I plan to apply Competitive Stock Valuation in search of some answers to the question.

~V

Posted by: Victor Cook, Jr., New Orleans, Louisiana | June 26, 2007 at 10:02 AM

Professor, I am not sure if that data is public. I am almost certain that they keep internal stats on that sort of thing. When I was on the CME Board of directors, we used to know response time, down time etc. I think exchanges would classify that as proprietary knowledge. CME's GLOBEX response time is now faster than you can blink your eye. We had one time in the last six months that we were down for a short period of time.

I recalltrading busy markets in the late nineties on GLOBEX, and you visibly could see the screen slow, and even get out of focus and waver. I have not personally traded ICE products, but my friends that do tell me that their system has these types of problems frequently.

I have traded on the Eurex system, and the LIFFE system (Connect). They are not as robust as GLOBEX. Eurex has a great system for executing simple trades in one commodity month. LIFFE has a better system in my view, but their spread functionality is not as good as GLOBEX.

It is clear that CME has a scalable engine, because they recently put NYMEX products on it with no slow down or trade matching problems. 60% of CME employees are now technical computer jocks. It has become not only a trading company, but a technology company.

The CME clearinghouse is also very scalable. We added the CBOT some time ago without a hitch (2003?). NYMEX uses a similar platform to clear trades that the CME developed in the mid nineties. It was then called "Clearing 21". Each exchange continued to enhance the platform in different ways once they developed it. CME has never had a problem paying and collecting, and margining out of its clearinghouse regardless of the amount of money it moves or the volume of trade.

It is interesting today to follow the Amaranth testimony on ICE. Apparently ICE did not keep too good of tabs on the Amaranth trader, and it lead to disaster in the Heating oil market. Part of this is due to a CFTC loophole, but part of it must fall on the exchange involved.

To further clarify on CME interest. They accept deposits into the Clearing house in which they pay interest. Conversely, they receive interest on the funds when they deposit them on the CME's bank account.

This is done each and every day, not dissimilar from overnight repos done with the fed. CME netted around two million from these activities inthe past fiscal year. There is not a short term loan, or long term loan on the CME balance sheet. They are debt free. In notes to the financial statements, you will see a schedule explaining the borrowing and lending activity. All of it takes place within the clearing house.

We do need a volume weighted number to find out actual COGS, but I would assume that it is proprietary too! Can't give your competitors too much information about where the volume is coming from!

I hope the CBOT shareholders vote YES for the deal. The two exchanges together can make a great economic powerhouse.

I think that NYC is losing its stature not necessarily because of Sarbanes-Oxley, though it's a contributing factor. They are losing it because the price discovery of the market is taking place away from NYC, and on futures and options screens. The cash equity market is not growing.

Posted by: Jeff | June 25, 2007 at 01:36 PM

Jeff,

By my count of the CFTC major exchange trading records, BOT had 513.0 million open contracts in 2006 compared with 67.4 million for NYBOT. A major capacity expansion would be required if ICE wins the bidding. With current trading platform technology is this a serious challenge? On the issue of reliability, doesn't someone have downtime data on all the exchanges?

~V

Posted by: Victor Cook, Jr., New Orleans, Louisiana | June 23, 2007 at 02:01 PM

Jeff,

Thank you for your thoughtful reply to my last questions. As before, I've plugged quotes from your latest reply (IN CAPS) into the remaining areas concern so we both can see what differences remain. This does indeed clarify most of the issues raised in your original comments. Unfortunately, I don't own any CME shares. Or shares in any other companies mentioned on my blog.

YOU NEED TO LOOK AT ECONOMIC NUMBERS

Please tell me what economic numbers I should use in place of financial accounting data.

"IT IS BEST TO AT LEAST LOOK AT THE PROXY DOCUMENTS PUT FORWARD BY THE M+A GUYS TO LOOK AT THEIR NUMBERS TO TRY AND GET A HANDLE ON THE REAL NUMBERS."

We're getting closer. But I need to know more. Please share with me the answer to these two further questions:

1. What exactly do "their numbers" measure?

"THE ECONOMIC NUMBERS I AM TALKING ABOUT ARE THE CASH FLOWS PRESENTED IN THE MERGER DOCUMENTS. I HAVE A COPY OF THEM, BUT HAVE NO WAY OF TRANSPOSING THEM HERE. THEY DO NOT SHOW NUMBERS FOR ICE ... "

2. How can individual investor can get access these numbers?

"ONLY SHAREHOLDERS OF RECORD WERE MAILED THE MERGER DOCUMENTS. ... THEY CALCULATED TEN YEARS OF CASH FLOWS AND DISCOUNTED THEM, INCLUDING A TERMINAL VALUE."

Well, here's where I take issue with the investment bankers. How can they calculate, with any reasonable degree of confidence, ten years of cash flows for the merged CME/BOT without considering the impact ICE would have on the results? Recalling the limitation of my single period analysis, you can at least see that placing ICE in the picture would have a significant impact on the merged results of the CME/BOT combination.

YOUR COGS IS VERY FLAWED

Aren't most all of the "internal costs that it takes to trade a contract" are incurred whether or not a give trade is made?

You clarify your concern by saying "... NO ONE RATIONAL WOULD USE INTEREST RATE CHARGES TO IMPUTE COGS UNLESS THERE WAS AN ECONOMIC REASON TO LINK INTEREST TO COGS."

I wouldn't use interest rate charges impute GOGS unless I though there were an economic reason to do so.

But, you didn't answer my question. Can I assume it's correct to say that most all internal costs that it takes to trade a contract (e.g. people, occupancy) are incurred whether or not a given trade is made? To be clear, are the strictly variable costs of all trades made in a quarter far less than the fixed costs of the trading operation? By variable costs, I mean those that would NOT be incurred if a trade were not made.

"THE EXCHANGE BUSINESS IS A FIXED COST BUSINESS. THERE IS LITTLE VARIABILITY TO THEIR COSTS. EVEN IF NO ONE MAKES A TRADE THAT DAY, THEY INCUR THE SAME COSTS AS IF TEN MILLION TRADES WERE EXECUTED. THE FIXED COSTS ARE THE LABOR TO RUN THE COMPUTER SYSTEM, AND TRADING FLOOR. IT USED TO TAKE AROUND 30 MILLION A YEAR TO OPERATE A TRADING FLOOR."

Okay, this is no longer an issue. The only distance between us now is that I call these fixed costs Enterprise Marketing Expenses – because EMEs are the costs of anyone (or anything) that affect a company's performance in its competition for customers and capital. EMEs are listed in my original post along with the financial accounting numbers that measure their importance in each company.

In 2006 BOT spent $343.8 million on enterprise marketing expenses, or $0.43 per dollar of revenue. ICE spent $166.0 million, or $0.47 per dollar revenue. CME, by far the most efficient, spent $614.4 million, or just $0.35 per dollar revenue.

CME CARRIES NO DEBT

Then how did CME incur $92 million in interest expenses in 2006?

I understand that "PAYS AND COLLECTS EQUAL ZERO EVERY DAY." But I still don't understand how CME incurred that $92 million in interest expenses. Do you know?

"THE INTEREST THAT YOU SEE IS FROM THE OPERATION OF THE CLEARING HOUSE."

We seem to be closing in on this issue too. Multiplying your estimate ($0.09) of the direct cost of one round turn by your estimate of CME trading volume (1.3 billion round turns) leads to a COGS of about $117 million. That number is remarkably close to the interest expense CME reported in its income statement: $92.10 million.

Is it fair to say the operations of the cleaning house gives economic meaning to assuming interest expense is the COGS? Or is this just a coincidence in the case of CME? In any event, earning interest from margin deposits offsets this number by "around 2 million."

I understand that at CME, and the other exchanges as well, have:

"...DIFFERENT CONTRACTS [THAT] HAVE DIFFERENT COSTS, SO IT IS VERY HARD TO KNOW WHAT THEIR ACTUAL REVENUE PER CONTRACT AND COST PER CONTRACT IS."

So, to get at the true COGS we need the volume weighted-average cost per full turn. I'd be surprised if someone in accounting didn't calculate this number on a monthly basis. Do you know if they do?

~V

Posted by: Victor Cook, Jr., New Orleans, Louisiana | June 22, 2007 at 04:00 PM

here is a link to an article. this is really the crux of the issue why CME is a better long term play than ICE. For those that do not know who Richard Dennis is, he is a legendary trader in Chicago. There have been several, and Richard Dennis is among the top five.

www.suntimes.com/business/437244,CST-FIN-dennis21.article

Posted by: jeff | June 22, 2007 at 08:18 AM