On December 31, 2007 Southwest's (NYSE: LUV) share of the $28.4 billion quarterly revenues generated by nine domestic air carriers was 8.4%. Question: What was LUV's share of market cap on that date?

Even if you have a large position in the stock, you may not know the answer. Why? Market share is a marketing metric. Does market share of group capitalization make sense?

SOME BACKGROUND

The overarching purpose of my book Competing for Customers and Capital is to forge links between finance and marketing. Specifically, to show how the markets for customers and capital interact in generating revenues and creating value. But before I jump into that, take a look at how market share most often is used in the press.

In their February 7, 2008 article, "Northwest and Delta Talk Merger," Andrew Ross Sorkin and Jeff Bailey make just one reference to market share, one which is not share of capitalization:

United, with strong Pacific routes, a big Chicago hub and a large market share on the West Coast, would complement Continental, which has big hubs in Houston and Newark and gets more of its revenue from international flights than any other big domestic carrier.

Similarly, in Jeff Bailey's January 17, 2008 NYT article,"In the Math of Mergers, Airlines Fail," he makes only one reference to market share, and again, it's one which is not share of market cap:

The second theory used to justify airline mergers is that combining would increase revenue because a bigger route system would help take market share from competitors.

In fact, references to market share in The New York Times are unusually frequent compared with other sources, including financial blogs. They may have a gut feeling about the importance of market share. The markets for customers and capital interact in many subtle ways that affect stock price. Which in turn affects revenue. The purpose of this new series on airline mergers is to show the importance of tracking that interaction.

THE BASIC DATA

The following table presents the basic data on market value and revenues. The first column lists the ticker symbols of the nine airlines used in this analysis. The second column lists the closing price of each stock on February 29, 2008. This is followed by the number of shares outstanding (in millions) on December 31, 2007. Next market value in billions, the arithmetic product of price and shares out, appears in the 4th column. Finally revenues (in billions) are listed in the last column. The shares out and revenue data were downloaded from the EDGAR Online I*Metrix financial database.

By the way, notice the group's total market value ($28.84 billion) and revenue ($28.36 billion) are nearly equal. That is the group's value/revenue ratio is about one, which is exactly what I found to be the long-run expectation.

VALUE-REVENUE DIFFERENCES

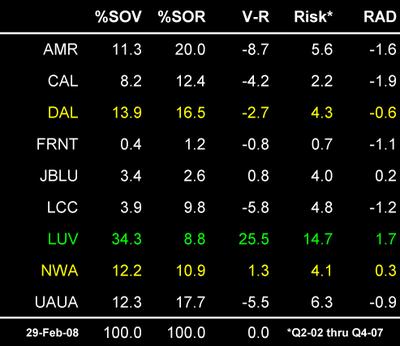

It's simple to convert the basic data into share of value [%SOV] and share of revenue [%SOR]. That's done in the following table for the same nine airlines. The value-revenue [V-R] differential is calculated in the 4th column. For example, American Airlines' (NYSE: AMR) value-revenue differential is -8.7%. The company generated 20.0% of revenues in the last quarter of 2007, but it created only 11.3% of the group's market value. Is this a bad thing? Yes, its market churn was nearly twice its value creation.

The answer to the question I asked at the top of this post appears in the table above. LUV created 34.3% of the group's market value with only 8.8% of group revenues, or, the Southwest Airline employees share of value was about 4 times the share of revenue. Is this a good thing? Yes. If you're interested in the theory behind this metric and how it behaves over the long-run in the airline industry check out my audio slide show Y'all Buckle That Seat Belt.

HIGH-FLYERS AND BOTTOM-FEEDERS

Do data in the table above shed light on a possible merger brtween Delta (NYSE: DAL) and Northwest (NYSE: NWA)? Begin with their V-R differentials: DAL has a negative differential of -2.7 points while NWA has a positive differential of +1.3 points. The volatility [Risk] in these differentials is measured by their standard deviation over the 23 quarters from the Q2-02 through Q4-07: 4.3 and 4.1 respectively for DAL and NWA. Dividing the differentials by their risk creates a risk-adjusted differential [RAD].

Since it is a standard normal variable, with mean 0.0 and sigma 1.0, any value of RAD greater than +2.0 identifies a company as a high-flyer. Any company with a RAD greater that +2.0 is performing two standard deviations above the expectation. The chance of observing this extraordinary performance is about 5 in 100. In the last quarter of 2007 LUV was approaching this upper limit with a RAD of +1.7.

Alternatively, any company with a RAD less than -2.0 is a bottom-feeder. Its performance is two standard deviations below the expectation. The change of observing this weak performance also is about 5 in 100. In the last quarter of 2007 AMR was approaching this lower limit with a RAD of -1.5.

DAL+NWA = BOTTOM-FEEDER

The following table summarizes the implications of a DAL-NWA merger using this theory.

The markets have had plenty of time to anticipate effects of the merger and incorporate them into the prices of DAL and NWA. Both are valued at a little over $13 and both have a similar number of shares outstanding. So, a back-of-the-envelope valuation of the combined companies is the arithmetic product of the mean of their individual prices ($13.39) and shares outstanding (280.73 billion). This leads to a merged market cap of $3.759 billion. Taking a neutral point of view on the revenues of the combined companies, I added their Q4-07 revenues.

NOT A PRETTY TAIL

Under these assumptions the merged companies would have a %SOV of 15.0 and a %SOR of 27.4. Since the value share of combined companies historically is less volatile than the separate organizations, the standard deviation in their V-R differentials over the 23 quarters is 2.6. This returns a risk-adjusted differential of -4.9. Almost 5 sigmas into the negative tail of the distribution of risk-adjusted differentials.

Will this analysis prove to be accurate? Probably not. But it gives DAL and NWA management food for thought. Perhaps even more important it also gives them a new way to study the unintended consequences of a merger. What do you think?

Thanks for visiting. As always I welcome your comments.

~V

Richard,

Thanks for the tip on the USA Today article. US Airways (LCC) closed today at $11.56. The high reported in the article was booked on November 22 (and again on the 24th), 2006. The loss of value between those two points is 81.6%.

A better baseline comparison is with LCC's closing price the day it went public on September 29, 2005 after emerging from bankruptcy: $20.21 per share. The loss of value between those two points is 42.8%. The run up to the high of $62.95 was due in large part to the merger itself. And to their bid for Delta.

~V

Posted by: Doc | March 06, 2008 at 05:42 PM

Victor, thanks for your comments. Your discussion about unintended consequences is echoed in today's USA Today in an article about the 2005 AmericaWest-US Airways merger. The merged airline has seen some solid results from their merger, though the stock price for the combined firms has dropped, says the article, nearly 80% since the merger. Meanwhile, integration issues of service, operations, and employee relations persist. See the full story at this link:

http://www.usatoday.com/money/industries/travel/2008-03-05-usairways-america-west_N.htm

Posted by: Richard Lewis | March 06, 2008 at 03:21 PM

Richard,

P.S. I like the way you handled the references at the bottom of your comment. Rather like an academic journal article. This way they don't get in the way of the story.

Thanks again,

~V

Posted by: Doc | March 06, 2008 at 10:53 AM

Richard,

Your link to the list of dissapointing mergers is a great primer on the risks of over-hyped M&A adventures.

Roger Lowenstein's penetrating look at domestic airline industry dynamics in his 2002 NYT article "Into Thin Air" is the real gem among your links. Readers might remember his account of the Long Term Capital meltdown in "When Genius Fails." That book provides the quintessential lessons in both the magic and misery of extreme financial leverage.

Readers interested in an historical account of the top eight domestic airlines' performance should consult "Key Success Factors." It's an eye-opener!

Thanks for this value packed comment. I intend to draw on these sources in my next post in this series.

~V

Posted by: Victor J. Cook, Jr. | March 06, 2008 at 10:49 AM

From the standpoint of corporate strategy, the merger probably looks good to DAL and NWA management. The share of revenue of the merged twosome goes up, they can imagine synergies in losing duplicated routes, personnel, and facilities, and for no good financial reason they will gain market share, for all the good it'll do them. Incidentally, fully agree with your comments about the limited understanding the business press has of the importance of market share and even of what it is.

The economics of the airline industry, which you have discussed in past posts, and your current numbers reflect, also suggest that this merger will have to struggle to succeed. The industry as a whole lost money in 10 of the 15 years from 1990 to 2005. (McCabe, 2006). In the 1990s, airline carriers filled 72.4 percent of their seats. Their break-even point was 70.4 percent. From 1995 to 1999, airlines earned 3.5 cents on every dollar of sales. American industry typically earns 6 cents. Through the entire 1990s, airlines made less than a penny on every dollar of sales (Lowenstein, 2002). Only ruthless economizing, shown in the widely-reported decline in service levels, has made some airlines profitable in the last two years, enabling both NWA and DAL to emerge from Chapter 11.

Recently as part of my Ph.D. studies I’ve been wrestling with stats. This has increased my understanding of the numbers you present. Five standard deviations! That's a long way down the negative tail. Your measure of corporate valuation for the merged firm should give management pause, as should the well-recognized fact that mergers are at best iffy propositions. In a July, 2007report, The Boston Consulting Group Inc., found that nearly 60 percent of the M&A deals it tracked from 1992 to 2006 caused the acquiring company's stock price to fall. And it noted that on average, "larger deals have a higher probability of failing." (Lai, 2008) This is supported by no less than Alfred Rappaport, who, in a 2002 column for The Wall Street Journal, reported that buyers as a rule pay too much for the companies they target. This comes from the acquiring companies being overoptimistic about cost-cutting opportunities and overestimating their management capabilities. Two-thirds of acquiring companies see their stock prices fall as soon as a deal is announced, Rappaport stated. This drop "usually corresponds" to the performance of merged stocks over the next year. The "sobering facts" about mergers and acquisitions, said Rappoport, are that "a majority of them don't work (Rappaport, 2002)."

References

Lai, E. (2008, February 6). A list of disappointing mergers. Cio.com. Retrieved March 3, 2008, from http://www.cio.com/article/180451/A_List_of_Disappointing_Mergers

Lowenstein, R. (2002, February 17). Into thin air. New York Times Magazine. Retrieved February 17, 2007, from http://query.nytimes.com/gst/fullpage.html?res=9C05E2D6103CF934A25751C0A9649C8B63&scp=1&sq=into+thin+air+lowenstein&st=nyt

McCabe, R. (2006). Airline industry key success factors. Graziado Business Report. CA: Pepperdine University. Retrieved March 3, 2008, from http://gbr.pepperdine.edu/064/airlines.html

Rappaport, A. (2002). Shareholder scoreboard (A special report)---To avoid a tumble, look for these red flags. Wall Street Journal, p. B.5.

Posted by: Richard Lewis | March 03, 2008 at 11:12 AM