Ever wonder why over the last 30 years Southwest Airlines managers (NYSE: LUV) spent only $0.03 on mergers and acquisitions for every $1.00 of shareholder value they created? By comparison Delta management (NYSE: DAL) spent $2.35 for every $1.00 of value they created. And Northwest (NYSE: NWA) spent $1.61 on M&A for every value dollar they created. In Louisiana we have a name for this kind of strategy. It's called jumping over a dollar to get to a nickel.

Does Herb Kelleher, former CEO of Southwest Airlines, know something about creating shareholder value that other CEOs don’t know? Perhaps he understands that in the domestic airline market earnings don’t necessarily increase with market share. Or in economics speak, changes in earnings with respect to a changes in market share may be very inelastic. Because the demand for air travel is very price elastic.

BELIEVE IT OR NOT

Believe it or not, elasticity is one of the most powerful metrics in business. In a single number, elasticity pins to the wall the relationship between percentage changes in price and quantity. In theory, if the percent change in quantity purchased by customers is greater than the percent change in price paid, demand is elastic. Alternatively, if the percent change in quantity is less than the percent change in price, demand is inelastic. Then why does one rarely see price elasticity numbers used in industry analyses? In the real world, price and quantity data are notoriously ill behaved. That’s why your econ 101 professor couldn’t use real numbers in his or her hand-drawn demand schedules. The axes on the graphs were always labeled p1, p2 and q1, q2. Remember?

It is, however, possible to get at the relationship between price and quantity in the real world. If you have access to a large base of precise data, an in-depth knowledge of econometric methods and lot’s of time on your hands. About the only people I know with these resources are doctoral students in economics. So I was not surprised to find exactly what I was looking for in Jong-Ho Kim’s 2006 dissertation on “Price Dispersion in the Airline Industry: The Effect of Industry Elasticity on Cross-Price Elasticity.” You can buy and download a copy of it from University Microfilms.

Dr. Kim based his research on data from the Department of Transportation’s Origin and Destination Survey from the 1st quarter 1989 through the 4th quarter 1997. This is a 10% random sample of all tickets issued in the U.S. In his dissertation Dr. Kim hypothesized that:

Southwest’s entry provides a natural setting for investigating how travelers respond to the changes in air fares. More specifically, we can make full use of variations in relative prices among airlines and the revenue shares of airlines by focusing on Southwest entry routes. Consequently, we can focus on coach class travel in those markets where Southwest entered and has been serving since then. … rival airlines adjust their average fares upon Southwest’s entry and remain relatively constant in ensuing quarters (page 12).

In that study when Southwest entered a new market (city-pair) estimated price elasticity ranged from a high of -2.6 (with only one other competitor), to -1.63 (with four other competitors), to a low of -1.1 (with 7 other competitors). All of these estimates were statistically significant.

WHAT HERB KNOWS

I think Herb Kelleher understands – as no sitting airline CEOs seems to – this fundamental principle about competition: given

• a capital intensive industry,

• with few meaningful scale efficiencies,

• delivering a highly perishable product,

• within a partly regulated infrastructure,

• operated by talented professionals,

• in a very price sensitive market, with

• free entry and court protected exit,

shareholder value can best be created organically. How? By maximizing the satisfaction of employees, passengers, suppliers, partners, and shareholders. Here is the corollary to that fundamental principle:

In airlines, building market share through mergers

short circuits the creation of satisfied stakeholders.

The purpose of this article is to examine why mergers don’t work today in domestic airlines, using the DAL/NWA merger as an example.

EARNINGS ELASTICITY

Elasticity can be expressed for any pair of variables. Take earnings elasticity for example. It’s the percent change in earnings divided by the percent change in market share. Here’s what happens. Cutting price leads to an increase in market share. But it also leads to a decrease in earnings. Theoretically, in a price elastic market with few scale efficiencies and a perishable product, earnings and market share are not happy partners.

Suppose the management of a hypothetical airline with 20% of all domestic revenues decides it would be good for earnings if they increased share of revenues to 30%. The quickest way to do that is to merge with a company that has 10% of the market. In a matter of months its market share increases by 50%. Bingo! But in a highly price sensitive market for a perishable product, earnings may increase only a little, say about 6%. The ratio of the percent change in earnings to the percent change in market share (0.06/0.50) is just 0.12. In this hypothetical case, earnings are highly inelastic with respect to market share. Is this is a bad thing? Yes. It’s a classic case of jumping over a dollar to get to a nickel.

MAXIMUM EARNINGS MARKET SHARE

To test the hypothesis that the DAL/NWA merger won’t be good for shareholders I ran a maximum earnings market share analysis on the combined companies in a strategic group with seven other domestic airlines for the calendar year 2007.

In a nutshell, maximum earnings occur when EBITDA generated by the last share point exactly equals the cost of acquiring it. I worked out the details of how to calculate maximum earnings share in my book Competing for Customers and Capital. I applied the results to eight domestic airlines in the 1st quarter of 2003 when only two of them weren’t losing money. If you want to get an overview of that analysis see my audio slide show The Rule of Maximum Earnings. It’s short and no walk in the park.

Table 1 sets the stage for this analysis with each carrier’s share of the combined $114.7 billion revenues in calendar 2007. American Airlines (NYSE: AMR) captured 20.0% of total revenue. UAL Corp (NasdaqGS: UAUA) walked away with 17.6%; Delta and NWA got 16.7% and 10.9% respectively.

Table 1

Continental (NYSE: CAL) generated 12.4%; US Airways ((NYSE: LCC) had 10.2%; followed by Southwest with 8.6%; Jet Blue (NasdaqGS: JBLU) at 2.5%; and Frontier (NasdaqGM: FRNT) with 1.2% of group revenues.

Combined, DAL and NWA actually captured 27.6% of total revenues. Since both carriers were financially cleansed by bankruptcy court, what is your guess about their potential to maximize earnings? The answer appears in Chart 1.

Chart 1

Combining DAL & NWA revenue and costs as they appeared on their individual income statements produced an actual 2007 market share of 27.6% of group revenues. The vertical axis on this chart is the marginal cost (the red schedule) as well as marginal earnings (the green schedule) per share point.

Marginal costs continuously increase reflecting the underlying reality of competition. The marginal earnings schedule is constant, reflecting the assumption that there would be no major changes in the scale of combined operations. Under this assumption, maximum earnings market share is 26.7% of group revenues. If synergies were to be found after merging, the effect would be to push actual and maximum earnings market share even closer together. In either event, the combined companies come within no more than 90 basis points of realizing maximum earnings. That’s the good news.

TOTAL EARNINGS ALMOST AS FLAT

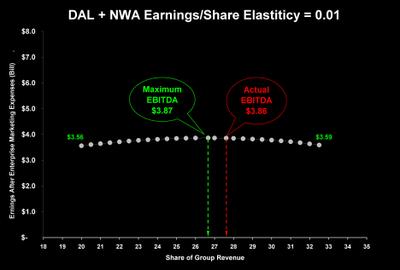

The bad news is the total earnings schedule is almost as flat at the marginal earnings schedule. Chart 2 tells the story.

Chart 2

In Chart 2 market share appears on the horizontal axis ranging from 20% through 35% of group revenue. In this chart, total earnings appear on the vertical axis ranging from zero to $8 billion. There is just a $10 million difference between actual and maximum earnings.

A DOUBLE WHAMMY

I began this article by pointing to the painful price elasticity that exists in this capital intensive market for perishable products. For carriers competing with Southwest in the same city-pair, reported price elasticities range from -1.1 upwards to -2.6 depending on the number of competitors in the market. If you’re the only other carrier in a market with a 10% price premium in a city-pair boarding 1,000 passengers a day, 260 of them likely will switch to Southwest. So you have to match LUV’s price. If you’re competing for 10,000 passengers a day in a market with four other carriers, including Southwest, and you don’t match LUV’s price, 1,630 of them likely will switch to Southwest. So, you’ve still go to match its price.

But just as bad, you’re likely to be facing a highly inelastic earnings/share schedule. In the DAL/NWA example presented in this analysis, there is just a $30 million dollar difference between total earnings at a 20% share of revenues ($3.56 billion) and a 35% share of revenues ($3.59 billion). That represents just a 0.8% increase in EBITDA across a spread from 20 to 32.5 revenue share points, a 63% increase. Without extraordinary synergies, a merged DAL/NWA might be facing an earnings/share elasticity of just a little over 0.01.

In short, a painful price elasticity combines with zero earnings elasticity to squash earnings in the proposed merger between Delta and Northwest. It's a double whammy to airline managerment.

What’s an airline CEO to do in this situation? Reconfigure the business model. Is there a road-map on how to do that? Yes, it’s called The Momentum Effect by Professor J.C. Larreche of INSEAD. It’s going to be published in hard copy by Wharton next month. Full disclosure: I recommend this book as a co-author with a long history of collaboration. If you want a copy right away, you can download the PDF for just $18 USD.

Thanks for visiting. As always your comments are welcome.

~V

Airbusdriver,

I've discovered that a lot of people involved in the airline industry -- especially investors -- are not pleased that I favor more engaging solutions to the airlines' problems than mergers and acquisitions. Their response is to find whatever fault they can in my posts and ignore the opportunities presented by the solutions I propose.

Thank you for your kind remarks.

~V

Posted by: Doc | April 08, 2008 at 06:02 PM

It is rare (and refreshing) to find a financial person who is not in favor of airline mergers. As an airline employee who is equally unconvinced by all the merger hoopla spouted by investors who seem only interested in a quick return on share price, thanks for publishing your essay.

Posted by: Chuck | April 07, 2008 at 04:45 AM

Dr. Cook - I just posted an entry on my blog about Southwest and some additional reasons for its success. I think there is another reason for the difference in shareholder value created in different mergers. It seems as if many of the mergers pursued by mainline carriers have been driven by fear. They fear that they might be left out at the dance if everyone partners up. They also fear loss of market share. This fear seems to exceed all other fears and has driven airlines to fly routes at a loss and to acquire airlines they don't really want. I would imagine the focus is not on shareholder value gained but on shareholder value not lost. Its a battle of attrition that never ends.

Posted by: Airbusdriver | March 24, 2008 at 08:42 PM

SteveinSeattle,

Your question about Alaska Airlines is a good one. I don’t know why I added Frontier to the eight airlines used in the March 2003 analysis published in my book and failed to include Alaska. This is not splitting hairs. Though adding Alaska’s $3.51 billion revenues to the $114.7 combined revenues of the nine others should not make a significant difference -- you never know for sure without doing it. I’ll rerun the analysis and post the results as soon as I get a chance.

Regarding your other question, the differences in market shares you report from the DOT and those in my post are not a reason to distrust my results. The reason is that the DOT shares are based on revenue passenger miles (in billions). This definition is found in the Glossary of the Bureau of Transportation Statistics:

“One revenue passenger transported one mile in revenue service. Revenue passenger miles are computed by summation of the products of the revenue aircraft miles on each interairport segment multiplied by the number of revenue passengers carried on that segment.”

The market shares in my post are based on net revenues (in billions of USD) reported in the company financial statements ending December 31, 2007.

Thanks for your comments,

~V

Posted by: Doc | March 24, 2008 at 12:41 PM

Mr. Cook, how can I trust your numbers on airline revenue share when it fails to include Alaska Ailines which has higher revenue than Frontier? While the subject is interesting and you obviously spent a lot of time on it, this lack makes me question the validity of your research. According to the DOT, Bureau of Transportation Statistics, from Jan-Dec 2007, these are the market share numbers...quite different from those you quote.

American 14.8%

Southwest 12.2%

United 11.5%

Delta 10.8%

Continental 7.8%

Northwest 6.7%

US Airways 5.4%

JetBlue 4.2%

AirTran Corporation 2.9%

America West 2.8%

Other 20.9%

According to the BTS, Frontier had a 2007 market share of 1.5% while Alaska had 2.6%. Splitting hairs maybe, but your numbers don't add up.

"Table 1 sets the stage for this analysis with each carrier’s share of the combined $114.7 billion revenues in calendar 2007. American Airlines (AMR) captured 20.0% of total revenue. UAL Corp (UAUA) walked away with 17.6%; Delta and NWA got 16.7% and 10.9% respectively. Continental (CAL) generated 12.4%; US Airways (LCC) had 10.2%; followed by Southwest with 8.6%; Jet Blue (JBLU) at 2.5%; and Frontier (FRNT) with 1.2% of group revenues."

Posted by: SteveinSeattle | March 24, 2008 at 10:25 AM