Did you ever notice that financial metrics are two dimensional? Take the most recent reports on Citigroup (NYSE: C) from Yahoo! Finance:

P/E (Price to Earnings);

EPS (Earnings per Share);

P/S (Price per Share);

EV/R (Enterprise Value per Revenue).

All two dimensional. What's the missing 3rd dimension? Competition. When I tell my students this, one of them always says:

"That's easy to fix. Just compare the company on each ratio with its peers."

Sorry, but that's not the point. Applying a 2D metric to competitors does not a 3D comparison make. Does it really matter? Yes, it can matter a lot. As you'll see in this report. The second in my series on investment banks.

The purpose of this post is to document the different results produced by 3D enterprise marketing metrics. And to explain their significance to management and investors. I apply these metrics to Citigroup and four of its competitors: Goldman Sachs Group (NYSE: GS); JPMorgan Chase Co (NYSE: JPM); Merrill Lynch & Co. Inc. (NYSE: MER); and Morgan Stanley (NYSE:MS). I call these metrics "Differentials."

MARKET SHARE IS THE 3rd DIMENSION

Performance in a strategic group is relative. Management's belief in the superiority of their company's performance matters far less to investors than how it stacks up against its peers. In making comparisons with peers, it's the interaction between two separate but equally important markets that determine a company's shareholder value. There is simple and revealing way to assess how any public company is doing in both markets: compare its share of value (SOV) in equity markets with its share of revenue (SOR) in product markets. Market share is the 3rd dimension.

VALUE SALES DIFFERENTIALS

The following table reports SOV and SOR for each company in either the 1st or 2nd quarter of 2007 (depending on their fiscal year end). The first step in capturing the 3rd dimension in enterprise marketing is to take the difference between a company's SOV and its SOR. The result is the Value-Sales Differential (VSD).

Consider Citigroup. At the close of its first fiscal quarter in March, 2007 the company created $254.0 billion in shareholder value. This was 37.6% of the combined $675.8 billion value of all five firms. Yet, Citi's $43.0 billion in revenue was only 30.3% of the $142.1 billion in combined sales revenues. The VSD was +7.3 points. In short, Citigroup's value creation in the period exceeded its revenue churn by over seven points.

On the other hand, at the close of its first fiscal quarter in March, 2007 Merrill Lynch created $71.4 Billion of the group's total $675.8 billion in shareholder value. This was only 10.6% of the group's total value. In the same quarter MER generated revenues $21.5 billion, or 15.1% of group sales revenues. Leading to a value-sales differential of -3.8 points. In short, MER's revenue churn exceeded its value creation by almost four points in May, 2007.

Finally, notice the sum of value-sales differentials over the five companies is zero. Is this an accident? No. The sum of V-S differential across a sample of companies in the same time period has to be zero. That's because we're taking the differences between two sets of integers that both sum to 100.

WHY A DIFFERENTIAL?

You may wonder why I use a differential rather than the ratio of value to revenue. Actually I use both, but for different reasons. There are three reasons for using a differential in this 3D enterprise marketing metric. First, a differential is derived from my theory of enterprise market shares. If you're interested in the details see the 18 minute Adobe Connect presentation "Y'all Buckle that Seatbelt." Second, a differential is better behaved than a ratio. It's bounded by upper and lower limits of +100 and -100 points. The upper limit of a ratio is unbounded. Third, no matter how large or small the differential is for any given company, the sum of the differences for a cross-section of companies will always be zero. These properties ensure that value-sales differentials are comparable across strategic groups of any size and time period. In short, the value-sales differential is a standardized 3D enterprise marketing measure of relative firm performance in stock and product markets.

WHAT ABOUT RISK?

Of course these differentials change from period to period. How do I control for that? In basically the same way risk is handled in corporate finance ... by adjusting for volatility. The classic risk-adjusted rate of return in finance is calculated in two steps. First, the risk-free rate of interest is subtracted from the returns on a given portfolio over time. Each of these returns then is divided by their standard deviation. I use a simple variation on this theme. First, share of revenue is subtracted from share of value in a given strategic group over time. Each of these differentials is then divided by their standard deviation.

CALCULATING RISK-ADJUSTED DIFFERENTIALS

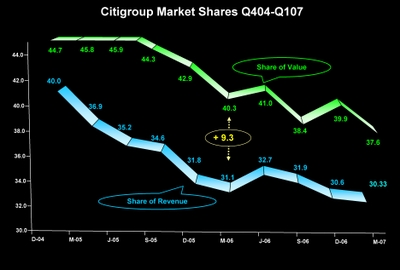

This chart shows Citigroup's share of value (in green) and its corresponding share of revenue (in blue) over the ten quarters from December, 2004 through March, 2007. In contrast to the table above (where Citi's SOV and SOR were 37.6% and 30.3% respectively in M-07) here you see the whole time series. [Click on chart to enlarge]

Citigroup's VSD increased from +4.7 points in D-04 to +7.3 points in M-07. It peaked at +9.3 in M-06. If you calculated the standard deviation of Citi's ten differentials you would find it's 1.97. Dividing each VSD by 1.97 creates a risk-adjusted series. For example, the company's risk-adjusted differential in M-06 was +4.7 (9.3/1.97). Make a note that both SOV and SOR are multiplied by 100 to create a whole-numbered index. This transformation is important because it makes the results much easier to interpret. Also note that RAD is a standard-normal variable: its standard deviation is 1.0 and its expected value is zero. This is a particularly useful property when interpreting its meaning.

INTERPRETING RISK-ADJUSTED DIFFERENTIALS

RAD is standard normal whole numbered index of a firm’s simultaneous performance in stock and product markets. As a result, you can draw several conclusions from a firm's risk-adjusted differentials. Here are just three general cases. Whenever RAD:

• Hovers around zero for a number of periods, investors have neither awarded a premium to nor discounted from the company’s share of market value relative to its share of revenues. This reflects average expectations for the company's future product/stock market performance.

• Is a positive number and greater than +2.0, investors have awarded a significant premium to the company’s share of market value relative to its share of revenues. An unbroken series of RAD numbers greater than +2.0 reflects high investor expectations for a company's future product/stock market performance.

• Is a negative number and less than -2.0, investors have significantly discounted the company’s share of market value relative to its share of revenues. An unbroken series of RAD numbers less than -2.0 reflects low investor expectations for a company's future product/stock market performance.

Of course, the world is not this simple. Given the definition of RAD it is rare to observe numbers either greater than +2 or less than -2 over several time periods. The investment banks in the following analysis make this point.

LEADING AND FOLLOWING BANKS

This chart shows risk-adjusted differentials for the leader (Citigroup) and a follower (Merrill Lynch) in a strategic group of five competitors. The Y-axis calibrates risk-adjusted differentials, ranging from -8.0 to +8.0. The X-axis calibrates time in quarters. The dashed gray lines at +2.0 and -2.0 are akin to statistical control limits at two standard deviations above and below the expectation. Any observation above or below these limits is statistically significant at a 95% confidence level. [Click on chart to enlarge]

Citigroup is one of those exceptional cases. It posted RADs greater than two standard deviations above the mean in all ten quarters. In a study I did of 38 Marketing Science Institute member companies and 299 of their competitors from 1991 through 2000, I found only twelve (3%) posted RADs greater that +2.0 in every period. So it is with good reason that I call companies like Citigroup "High-Flyers."

As you would expect, the lion's share (91%) of all firms in my study of MSI companies and their competitors posted RADs that remained between plus and minus 2.0 over the entire decade. Merrill Lynch is one of these "Average Joes." But there's more information in MER's numbers. First, notice all of its RADs are less than zero – it performed below average in all ten quarters. Second, the trend is not favorable. Third, this already unfavorable trend dropped to -3.8 in March, 2007. This is not a good sign.

CANDLESTICK RADs

The candlestick chart is an efficient way to summarize the risk- adjusted differentials of all five companies over the ten quarters. In this chart two companies (GS and C) have green candles because each has an ending RAD in March/May 2007 greater than a beginning RAD in December/March 2005.Three companies (MER, MS, and JPM) have red candles because each has an ending value less than a beginning one. [Click on chart to enlarge]

The size of a candle itself represents the spread between beginning and ending RADs. For example, MER's candle portrays the beginning and ending ones in the earlier time series chart, 0.4 and -3.8 respectively. It also captures the downward trend since no value outside this range appears as "wick" on top of MER's candle.

The wicks on each candle in this chart represent extreme departures from the beginning and ending RAD numbers. For example, Morgan Stanley posted a low of -7.2 in one quarter. And while Goldman Sachs posted a big increase, from -2.2 to -0.2, it none-the-less experienced a low of -3.7 in one quarter along the way.

SHOULD YOU WORRY?

Should Merrill Lynch, Morgan Stanley, and Goldman Sachs be worried about their risk-adjusted differential performance? Yes. Investors are telling management that something's substantially wrong ... relative to the performance of their peers. You can't pick up this signal from any two-dimensional financial indicator. In fact, some of the common indicators used in stock valuation can be downright mollifying.

Consider the market value/revenue multiple for example. Merrill's v/r multiple (ttm) slipped the most from 1.55 to 1.07; a 31% drop. And Citigroup's fell from 1.98 to1.64; an 18% drop. While Morgan Stanley's went from 1.18 to 0.99; a 16% decline. Finally, JPMorgan's fell from 1.61 to 1.56; this 3% decline was the smallest of all five companies.

2D IS TOO NARROW

Two dimensional financial metrics are too narrow because they fail to incorporate directly the effects of competition. Should investors re-evaluate Citigroup and its peers in light of the added information contained in their 3D enterprise marketing metrics? What do you think?

Stayed tuned for the third installment in this series on investment banks: "Citigroup Enterprise Marketing Risk and Efficiency" will appear next week. Same time, same place.

~V

Veryinterested,

The short response to the issues you raise is this: Strategic groups are inherently dynamic collections of companies that compete simultaneously for customers and capital. The companies that managers think are their competitors will change from year-to-year, if not from quarter-to-quarter.

MARKETING'S MYOPIA

The greatest blinder to understanding enterprise marketing was planted in the mind of every business school student by marketing professors themselves: Their micro-marketing perspective says that companies are competitors only if they serve the same customers, fulfill the same needs, and deliver the same solutions. When you add the dimension of competing simultaneously for customers and capital, then throw in the impact of M&A dynamics on the competitive landscape, it's clear that this conventional definition of competition is not up to the job of analyzing enterprise marketing strategies.

DO WHOLE FOODS AND KROGER COMPETE?

Grocery stores in the same trading area with the same mix of products and services that compete for the same customers would fit the micro-marketing definition of competing firms. However, such a narrow focus makes it impossible to conduct an analysis of the competition for shareholder value. You can't measure the market value of a local supermarket because it is not traded on a stock exchange. Such a restrictive definition of a grocery chain strategic group also would exclude Whole Foods Markets Inc. as a competitor of Kroger. This omission would hide useful enterprise marketing information from investors.

Theoretically the companies in a strategic group have (or might acquire) a high degree of market commonality and resource equivalence. If you're interested in the details, see my 11 minute Adobe Connect presentation "Who's in My Strategic Group?" at http://breeze.tulane.edu/cookchapterthree/

PRACTICAL IMPLICATIONS

What does this mean in practical terms? The companies currently (or might in the future) share a lot of customers and have similarly deep pockets. Using these criteria the five "investment banks" in my analysis can properly be treated as strategic group. Many others also could be included, especially European and Asian banks, that are beginning to make inroads in U.S. markets.

A trade-off between "deep pockets" and "shared customers" is involved in the definition of a strategic group. In the broadest sense, every firm is in competition with all other firms in its competition for capital; however, a limit is imposed by the requirement for some level of current (or anticipated) product market commonality. Otherwise, we lose an important dimension of the competitive effects (shared customers) embedded in a strategic group. In the narrowest sense, there exist few pure competitors for a firm’s customers since its products are, to some extent, unique.

THIS INVESTMENT BANKING GROUP

My goal in this analysis was to achieve a balance between the market commonality and resource equivalence among investment banks. In addition, I wanted a definition that will be meaningful in the future. Ask yourself: Do these investment banks fill this bill?

A FINAL POINT.

Subtracting Citigroup's non-overlapping revenues will not improve the analysis because you cannot subtract that portion of its market cap created by those revenues. Enterprise marketing requires a new and different perspective on competition.

Thanks for your comments.

~V

Posted by: Victor Cook, Jr., New Orleans, Louisiana | July 16, 2007 at 11:53 AM

The concept you describe may have merit, but it can only be useful if markets are defined correctly.

For example, if you look at the revenues and earnings of Citigroup and Goldman, you will find that Citi participates in many markets that Goldman does not participate.

Thus to make a meaningful comparison between Citi and GS, you should subtract from Citi's totals the revenues and ascribed market value for activities in which GS does not compete. Only then can you make a direct comparison between Citi and Goldman.

Now, the comparsion may be somewhat more valid between Citi and MER and MS, because MER and MS engage in a broader range of activities. But, even MER and MS do not really compete over the broad range of Citi's activities.

Posted by: veryinterested | July 16, 2007 at 10:18 AM