Carly Delivered While Investors Fiddled

THE OLD HP (NEARLY) MAXIMIZED EARINGS

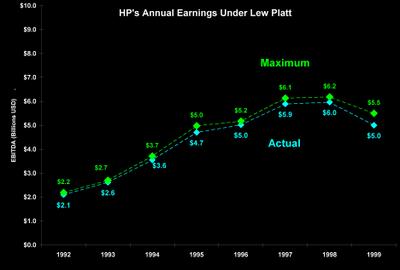

My analysis of The Battle for Your Desktop from 1991 through 2000 revealed the extraordinary performance of IBM under the leadership of Louis Gerstner. But there was another surprising story in that period. This chart shows how HP performed under the direction of Lew Platt, President and CEO of the company from 1992 through 1999.

During this period HP nearly maximized earnings. For example, in 1992 actual earnings (in blue) were $2.1billion, or 96% of their maximum potential. Over the eight years of his tenure actual earnings averaged 95% of potential: Lew earned a cumulative total of $34.882 billion while his maximum potential earnings were $36.593 billion. But he began to fall short of maximum earnings in 1995 and worse, actual earnings fell in 1999. While performing at 95% of potential was good, that 5% shortfall left almost $2 billion in potential earnings on the table. And over 80% of that was lost from 1995 through 1999. Partly explaining why the board went for looking for fresh leadership. They found it in Carly Fiorina and she took over as HP's new CEO in July, 1999. As the say, the rest is history. Except, in this case history got it wrong! The purpose of this post is to set the record straight.

FIORINA OUT, HP STOCK SOARS

On February 10, 2005 this was the headline in Paul La Monica's lead story on CNNMoney.com. The author calculated that HP's shares were up 6.9% on heavy trading and reported:

"The stock is up a bit on the fact that nobody liked Carly's leadership all that much," said Robert Cihra, an analyst with Fulcrum Global Partners. "The Street had lost all faith in her and the market's hope is that anyone will be better."

The article also contained a "Quick Survey" asking readers this question: Is Carly Fiorina's departure a good thing for Hewlett-Packard? Out of 27,345 responses 71% said it was a good thing.

CARLEY TELLS HER STORY

Twenty months to the day after the HP board fired Carly Fiorina her book Tough Choices: A Memoir hit the news stands. Simultaneously, an interview by Fred Vogelstein appeared in Wired. Near the end of that interview this dialog appeared:

Vogelstein: What would you have done differently about your tenure at HP?

Fiorina: I guess what I wish I had understood at the outset -- and I clearly didn't -- is how much of a symbol of change everything about me was. Everything about me was a challenge to some people, and I don't think I understood that. … But you know, if I think back on the big things, the decisions that really defined my legacy, my tenure -- the decision to come in alone (without my own team) and engage the organization in its own transformation, the decision around the merger, even the decision about how to describe my departure from the company, as a firing as supposed to a decision to resign -- those big decisions I wouldn't do differently in retrospect.

INVESTORS' IRRATIONAL GLOOM

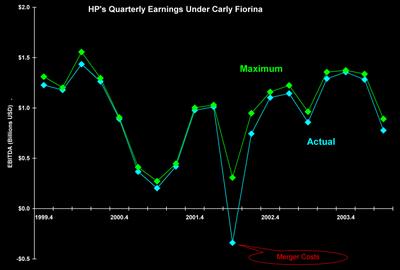

HP's value/revenue multiple jumped to 9.3 during Carly's first year on the job, up from 6.0 in the last three years of Lew's tenure. But investors were unhappy with the merger from the day it was announced. And they beat up HP's stock driving its value/revenue multiple down to 2.8 during her last year on the job. Given these numbers, it's easy to see why the board asked Carly to resign. But, as this chart makes clear, investor's suffered from irrational gloom regarding HP's performance under her leadership. Which partly explains why she refused to resign and described her departure from HP as a firing.

From the 4th quarter of 1999 through the 2nd quarter of 2004 actual and maximum earnings were closer under her stewardship than that of the previous CEO – with the exception of the merger expenses that hit the books in the 2nd and 3rd quarters of 2002.

Note there is marked seasonality in HP's quarterly data that was not revealed in the annual numbers reported in tne first chart. And all four companies in this strategic group suffered a similar dive in earnings when the bubble burst in 2000.

WHY?

Why did investors beat up HP's stock after the merger? Was it because Carly Fiorina performed poorly? This evidence says no. Well then, did they beat it up on the stock because she rubbed her managers and engineers the wrong way? Is culture shock enough to turn investors against an otherwise solid stock with a predictably great future? Or, was it because she is a woman who was just too successful?

~V