Gerstner's Rule in High-Tech Industries

In Who Says Elephants Can't Dance Louis Gerstner describes a measure of "Enterprise Marketing Efficiency" (EME). I call his measure "Gerstner's Rule." Apply this rule to any public company and you can see in a flash if the emperor has no clothes. And this metric is simple to calculate.

In Gerstner's description of the problems he faced as the new CEO of the faltering giant IBM company he said:

After months of hard work, CFO Jerry York and his team determined that IBM's expense to revenue ratio – i.e. how much expense is required to produce $1 of revenue – was wildly out of range with those of our competitors. On average, our competitors were spending 31 cents to produce $1 of revenue, while we were spending 42 cents for the same end. When we multiplied this inefficiency times the total revenue of the company, we discovered that we had a $7 billion expense problem! (page 62-63)

He set out to solve that problem. Over the years from 1993 through 2000 he took IBM from the brink of failure to maximum earnings market share. I trace this amazing story in Chapter 6 of my book. You can see a summary of it in my audio slide show on The Battle for Your Desktop. Though Gerstner didn't say exactly what "expenses" he used to calculate the EME ratio, my analysis leads to the conclusion he must have used "Selling, General and Administrative" expenses from the income statements of IBM and its competitors.

CAN YOU OFFER SOME INSIGHT?

In my April 16th post on "Microsoft's $8 Billion Problem" I applied Gerstner's Rule to the newest contestants in the continuing battle for your desktop: Google, Yahoo! and Microsoft. In his comment on my post Jonathan Knowles asked these questions:

… (can) you offer some insight into what constitutes excellence in EME in more mature industries? If my revenue growth is above the industry average and my EME ratio is 95% of the industry average, am I a star? Or does it need to be 90%? 80%?

In this short series of questions he is asking for a sweeping basic research study on the behavior of the EME ratio. And I intend to complete such a study in time. For now, all I can do here is take a first cut at answering his first question: What constitutes excellence in EME? But, to keep it in context I've applied the EME ratio to ten high-tech industries. In addition, I decided to look at the extremes of performance, including both excellence and inferiority, in the EME ratio.

EME AVERAGES IN HIGH-TECH

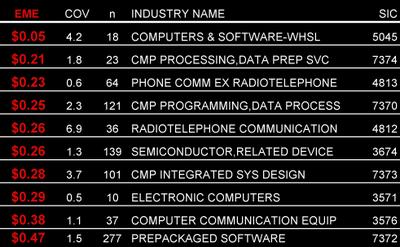

This table reports the EME to revenue ratios and their coefficients of variation (COV) for 549 companies in ten high-tech industries in 2005.

Let's take a close look at the first industry listed in this table: Computers and Software Wholesalers. The 18 companies reporting the data in SIC 5045 booked $62 billion in revenues and spent $3 billion on SG&A expenses. The expected value of their EME ratio was $0.05 [$3/$62 billion]. That these high-tech wholesalers spent only 5¢ to generate $1.00 in revenues should come as no surprise. After all, most of their business is repeat purchases from large customers.

The standard deviation in the EME ratio of the 18 computers and software wholesalers of $0.20 was 4.2 times the expected value. Such a large coefficient of variation suggests big differences among the reported SG&A expenses by these companies.

The highest enterprise marketing expense per dollar sales was incurred by the 277 companies in the Packaged Software industry. The relatively small COV of 1.5 suggests that ever if there were a wide range between the minimum and maximum EME ratio, they tended to cluster close to the mean of 47¢ per dollar of sales. This relatively high expense ratio should also come as no surprise. It just happens that this was Microsoft's EME ratio in 2006. Remember Google's ratio? It was just 27¢. That's where MSFT's $8 billion dollar problem came from. You could argue this is the real source of Microsoft's Google envy.

EME EXTREMES IN HIGH-TECH

The first table gives the impression of a pretty orderly underlying pattern. But as the next table shows this is far from the truth. The real underlying pattern is one of surprising extremes. I've highlighted three of them.

France Telecom's 1¢ per dollar of sales was the lowest among the 64 telephone companies. Proving once again, until you lose it, monopoly power makes selling a snap!

First Avenue Networks, in the Radio Telephone industry, spent $11 to get $1 in revenues in 2005. This was the lowest bang per buck of any of these 549 high-tech companies. In all fairness to First Avenue Networks, it was a start-up in 2003 and since has merged with Fibertower. Its march 31, 2007 income statement shows the EME per dollar sales have dropped to $1.70.

Finally, it comes as a surprise that Steve Job's little Apple Computer jumped over the likes of Silicon Graphics (46¢), Sun Microsystems (42¢), and Cray Inc (42¢) by spending only 17¢ to generate a dollar in revenues! And we see in Apple's March 31, 2007 SEC filing that its EME ratio dropped to 16¢. So much for scale efficiencies in enterprise marketing expenses.

MOMENTUM-POWERED COMPANIES

By chance, I'm in the middle of reading the pre-publication manuscript of a new book by my friend and co-author of Readings in Marketing Strategy J.C. Larreche, the Alfred H. Heineken Professor of Marketing at INSEAD.

The book's about momentum powered companies … like Apple Computer … and how they manage to produce greater market caps than their competitors with relatively lower enterprise marketing expenses. More importantly, with this book you can learn to do the same. Stay tuned. While JC's book may not hit the streets till early next year, I'll be telling you as much about it over the next months as Wharton Publishing will allow.

~V