Dell's Magic Marketing Machine: New Metrics You Can Use

Steve Lohr in his September 9, 2007 New York Times article “Can Michael Dell Refocus His Namesake” quoted Professor David Yoffie of the Harvard Business School:

Dell continued to do the same old thing, when it was no longer working. This is going to be about changing the way they do business at many levels.

Let’s hope Mr. Dell finds ways to do this without diminishing the power of his magic marketing machine. Chances are he won’t be able to. His recent move into retailing suggests that Mr. Dell himself does not appreciate the degree to which that marketing machine is the source of his competitive advantage. In the same article he is quoted as saying:

A lot has changed, Mr. Dell notes, since the company tried and abruptly exited retail sales in 1994. The shift in the consumer computer market and toward notebooks, which customers want to touch before buying, is part of it. So is Dell’s need to do better in markets abroad, where people are less comfortable buying computers by phone or over the Internet. “We’re going after those new customers with retail partners,” Mr. Dell says.

He may find those new customers “… at Wal-Mart stores in the United States, at Carphone Warehouse outlets in Europe and at Bic Camera stores in Japan” but selling through these and other discount retailers surely will undermine this competitive advantage.

SOME BACKGROUND

This is the second post motivated by a December 2004 paper titled "Dell Grows Up" written by four students in the Freeman School MBA program at Tulane University. My first post in the series “If Only Michael Dell Had Listened to the Numbers” reviewed the team’s analysis of Dell (nasdqGS: DELL) in a strategic group with Hewlett-Packard (NYSE: HPQ); International Business Machines (NYSE: IBM); and Sun Microsystems Inc. (NasdaqGS: JAVAD). The team members were Michael Calabrese, Supasith “Oak” Chonglerttham, Michael Dodson and Julie Gottbrath Bruton. They recommended that Dell undertake two strategic acquisitions in order to redefine its competitive position.

The purpose of this post is to apply and compare three different ways of measuring the performance of Dell’s magic marketing machine based on -- believe it or not -- financial accounting data! You can apply these three metrics to your company:

1. Gerstner’s Rule: The Cost Per Dollar of Revenues [CPD].

2. The enterprise Market Share Attraction model [MSA].

3. My own enterprise Marketing Efficiency Ratio [MER].

Each one answers the same question from a different perspective: Relative to its competitors how efficient is an enterprise in generating sales revenues?

GERSTNER’S RULE

In Who Says Elephants Can't Dance Louis Gerstner describes the first in this set of three measures of enterprise marketing efficiency. Since he was the first one to define it I call his measure "Gerstner's Rule." Its meaning is simple: less is more. Apply this rule to any public company and you can see in a flash if the emperor has no clothes. And this metric is simple to calculate.

In Gerstner's description of the problems he faced as the new CEO of the faltering giant IBM company he said:

After months of hard work, CFO Jerry York and his team determined that IBM's expense to revenue ratio – i.e. how much expense is required to produce $1 of revenue – was wildly out of range with those of our competitors. On average, our competitors were spending 31 cents to produce $1 of revenue, while we were spending 42 cents for the same end. When we multiplied this inefficiency times the total revenue of the company, we discovered that we had a $7 billion expense problem! (Who Says Elephants Can't Dance, page 62-63)

He set out to solve that problem. Over the years from 1993 through 2000 he took IBM from the brink of failure to maximum earnings market share. I trace this amazing story in Chapter 6 of my book Competing for Customers and Capital. Though Gerstner didn't say exactly what "expenses" he used to calculate this ratio, my analysis leads to the conclusion he must have used the enterprise marketing expenses of IBM and its competitors. For a discussion of what these expenses include see my September 30, 2007 post Microsoft’s $154 Question: Optimizing “Red Ocean” Expenses.

COST PER DOLLAR

Gerstner’s rule reveals dramatically the power of Dell’s magic marketing machine in the desktop space. The following table reports the cost per dollar [CPD] for Dell, Hewlett-Packard, Sun Microsystems and IBM in each of the ten quarters beginning with March 2002. Note the date-line in this table is synchronized on the quarter ending March 2002 because two of the four players in this group file quarterly reports that corresponded with the calendar year. Dell’s reporting quarter actually ended on May 3, 2002.

Dell’s CPD averaged just $0.10 compared with $0.21, $0.46, and $0.26 for HPQ, SUNW and IBM respectively. Over the ten quarters it cost Dell less than half as much as HPQ and IBM to generate $1.00 in sales revenue. And less than one-fourth as much as it cost SUNW. This first performance measure of Dell’s magic marketing machine can be calculated on the back of an envelope.

MARKET SHARE ATTRACTION

Market share attraction [MSA] theory says that on average in a competitive market a company will attract revenues in direct proportion to its share of the expenses incurred in serving that market. The popularity of this model is based on several characteristics: it's logically consistent; it derives from four simple axioms; its parameters can easily be estimated; and it seems to outperform both linear and multiplicative models.

An interesting investigation into the properties of the [MSA] model is available in the 2001 paper "Why is Five a Crowd in the Market Share Attraction Model: The Dynamic Stability of Competition" by Paul Farris and his coauthors. Their analysis assumes that firms maximize earnings by optimizing their own spending based on competitors' last-period budgets and the MSA model.

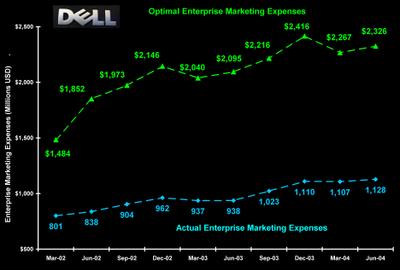

Market share attraction theory is the foundation of the second performance measure of Dell’s magic marketing machine. While it’s a bit more complicated, it’s also a lot more revealing. This scatter diagram shows Dell’s share of revenues [SOR] on the y-axis and its share of enterprise marketing expenses [SOE] on the x-axis. The same chart appeared in the team’s paper "Dell Grows Up" (Chart 4, page 9).

The dotted green diagonal line in this chart represents the long run expectation in market share attraction theory: that a company will attract revenues in direct proportion to the share of expenses incurred in serving the market. Dell knocked this expectation out of the park! In every quarter Dell’s share of revenues is more than double its share of enterprise marketing expenses. In August 2002 Dell accounted for 6.4% of the group’s expenses while generating 18.0% of group revenues. By August 2004 Dell generated 21.0% of revenues while incurring only 9.2% of enterprise marketing expenses. In all ten quarters Dell’s bang per puck was greater than two to one. Even as it share of revenues increased 300 basis points!

MARKETING EFFICIENCY RATIO

My marketing efficiency ratio [MER] is derived directly from market share attraction theory. It also is critical in the calculation of optimal enterprise marketing expenses. A company’s MER is simply its actual enterprise marketing expenses divided by its theoretical market share maintenance expenses. If actual and theoretical enterprise marketing expenses are equal, the MER is one. If actual expenses are less than theoretical expenses the MER is less than one. In this event the company is more efficient than its competitors. When actual expenses exceed theoretical expenses the company is less efficient. The following table reports marketing efficiency ratios for DELL, HPQ, SUNW and IBM.

Over the ten quarters from March 2002 through June 2004 Dell’s MER averaged 0.37 compared with 0.86, 2.07 and 1.45 for HPQ, SUNW and IBM. What does this mean? It cost Dell just 37¢ to buy enterprise marketing resources that cost the average competitor $1.00. More to the point Michael Dell and company paid just 37¢ for resources that cost HPQ 86¢; SUNW $2.07 and IBM $1.45. Clearly, the MER is the most revealing of these three measures of enterprise marketing efficiency. It’s also the most difficult to calculate.

WHICH METRIC IS THE BEST?

It’s always best to start with Gerstner’s Rule. First, it will give you a quick read on how you stack up against competitors. Second, in order to calculate CPDs you’ve got to look closely at the line items in your income statement and those of competitors that are enterprise marketing expenses. For a quick overview of these line items see my audio slide show “Enterprise Marketing Expenses.” This ensures you’re comparing apples with apples.

If you want greater precision, run the market share attraction [MSA] numbers. This requires that you calculate market share ratios on both revenues and enterprise marketing expenses. But the end result is more revealing because the MSA diagram will show if the data are real or just financial accounting noise.

Finally, if you want to optimize enterprise marketing expenses you need to run the marketing efficiency ratios. To do that you’ll need to put your hands on a copy of Competing for Customers and Capital. Then turn to Appendix A (pages 250-252) and code the equations into a spreadsheet. If you’re spending billions on enterprise marketing like Michael Dell does, it might be worth your trouble.

Thanks for visiting. Your comments are always welcome.

~V